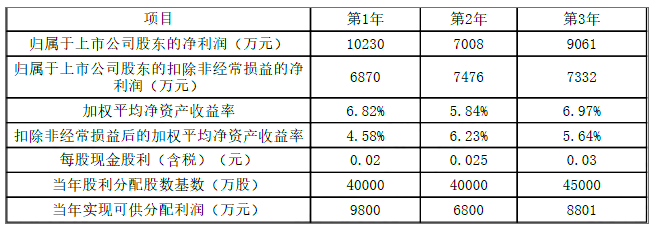

东方公司为一家在上交所上市的公司,该公司最近三年部分财务数据如下:

为扩大经营规模及解决经营项目的融资问题,东方公司决定在明年实施融资,有如下三个备选融资方案:

方案一:按照目前市场价公开增发新股。

方案二:发行10年期的公司债券,债券面值为每份1000元,票面利率为9%,每年年末付息一次,到期还本,发行价格拟定为950元/份。目前等风险普通债券的市场利率为10%。

方案三:公开发行优先股。

要求:

(1)根据有关基本财务条件的规定,判断东方公司能否采用公开增发方式。

(2)根据方案二,计算每份债券价值,判断拟定的债券发行价格是否合理并说明原因。

已知:(P/A,10%,10)=6.1446,(P/F,10%,10)=0.3855

(3)要使方案三可行,在发行数量和筹资金额方面需要满足什么条件?

(1)

相关的规定有三条:

一是最近三个会计年度连续盈利(扣除非经常损益后的净利润与扣除前的净利润相比,以低者作为计算依据),东方公司满足这个条件;

二是最近三个会计年度加权平均净资产收益率平均不低于6%(扣除非经常损益后的净利润与扣除前的净利润相比,以低者作为计算依据),东方公司不满足这个条件;

三是最近三年以现金方式累计分配的利润不少于最近三年实现的年均可分配利润的30%。

东方公司最近三年以现金方式累计分配的利润

=40000×0.02+40000×0.025+45000×0.03

=3150(万元),

东方公司最近三年实现的年均可分配利润

=(9800+6800+8801)/3

=8467(万元)

3150/8467×100%=37.20%,满足这个条件。

结论:东方公司不能采用公开增发方式。

(1)there are three related regulations:

First, the company has made continuous profits in the last three accounting years (the lower of the net profit after deducting the nonrecurring profit and loss compared with the net profit

before deducting the nonrecurring profit and loss is taken as the calculation basis), and Company Dongfang meets this condition;( 1 mark)

Second, the weighted average return on net assets in the last three accounting years should be not less than 6% on average (the lower of the net profit after deducting the nonrecurring profit and loss compared with the net profit before deducting the nonrecurring profit and loss is taken as the calculation basis), and Company Dongfang does not meet this condition;( 1 mark)

Third, the accumulated profits distributed in cash in the last three years should not be less than 30% of the average annual distributable profits realized in the last three years( 1 mark)

The accumulated profits distributed in cash in the last three years by Company Dongfang

=40000×0.02+40000×0.025+45000×0.03

= RMB 31.5million

The annual distributable profit realized by Company Dongfang in the last three years=

(9800+6800+8801)/3

= RMB 84.67 million (1 mark)

3150/8467 × 100% = 37.20%.

Conclusion: Company Dongfang can't adopt the way of public secondary offering( 1 mark)

(2)

每份债券价值

=1000×9%×(P/A,10%,10)+1000×(P/F,10%,10)

=938.51(元)

拟定发行价格高于每份债券价值,导致投资人投资该债券获得的报酬率小于等风险普通债券的市场利率,因此拟定发行价格不合理。

(2) Value of each bond

=1000×9%×(P/A,10%,10)+1000×(P/F,10%,10)

=RMB 938.51(1 mark)

The proposed issue price is higher than the value of each bond, which leads to the return rate of the bond that invests by investor is less than the market interest rate of the ordinary bond with equal risk. So the proposed issue price is unreasonable.( 1 mark)

(3)

根据规定,上市公司已发行的优先股不得超过公司普通股股份总数的50%,且筹资金额不得超过发行前净资产的50%,已回购、转换的优先股不纳入计算。

(3) According to the regulations, the issued preferred shares of listed companies should not exceed 50% of the total number of common shares of the company, and the financing amount should not exceed 50% of the net assets before the issue. The preferred shares that have been repurchased and converted should not be included in the calculation( 1 mark)

下列关于法律主体权利能力的表述中,正确的是( )。

甲开车不小心撞坏了电线杆,该行为属于()。

法人是具有民事权利能力和民事行为能力,依法独立享有民事权利和承担民事义务的组织。下列选项中不属于法人的是()。

根据法律规范的性质,可以将法律关系分为()。

2018年,中共中央下发《深化党和国家机构改革方案》,设立中央全面依法治国委员会,该委员会办公室位于( )。

下列规范性法律文件中,由全国人民代表大会常务委员会制定的是( )。

关于法人权利能力与行为能力的说法正确的是( )。

下列各项中,不属于全面推进依法治国基本原则的是( )。

下列关于法律渊源的表述中,不正确的是( )。

法律的制定部门是()。