当前位置:首页 → 职业资格 → 教师资格 → 小学教育教学知识与能力->请认真阅读下列材料,并按要求作答。请根据上述材料完成下列任务

请认真阅读下列材料,并按要求作答。

请根据上述材料完成下列任务:

(1)什么是数据分析观念?数据分析观念可以从哪几个方面来体现?(10分)

(2)依据拟定的教学目标,设计课堂教学的主要环节,并简要说明设计意图。(20分)

(1)数据分析观念包括:了解在现实生活中的许多问题应当先做调查研究,收集数据,通过分析做出判断,体会数据中蕴涵着信息;了解对于同样的数据可以有多种分析的方法,需要根据问题的背景选择合适的方法;通过数据分析体验随机性,一方面对于同样的事情每次收集到的数据可能不同,另一方面只要有足够的数据就可能从中发现规律。 数据分析的观念可以从三方面来体现:一是体会数据中蕴涵着信息;二是根据问题的背景选择合适的方法描述;三是通过数据分析体验随机性。

(2)教学目标

知识与技能目标:初步体验数据的收集、整理、描述和分析的过程,会用一格表示一的条形统计图来表示数据。

过程与方法目标:通过观察、比较,初步认识条形统计图的结构特点和优势,发展数据分析观念。

情感态度与价值观目标:通过数据的收集、描述、分析等问题的提出,培养问题意识,体会数学知识与实际生活的紧密联系.提高学习兴趣。

(3)教学环节

(一)导入新课

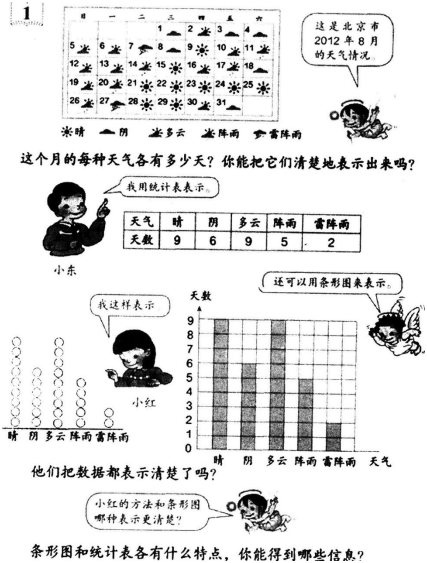

课件出示2012年8月北京市的天气情况图。引导学生认识和了解表示天气的各种图例。

师生交流后,提问:这是北京市2012年8月的天气情况,这个月的每种天气各有多少天?怎样才能把它们清楚地表示出来?

启发引导学生思考并整理数据:用什么方法统计?

生:小组合作交流。尝试用自己喜欢的方式来统计数据(数数、画√、写正字等),组织汇报交流。教师根据学生汇报的情况逐一评价。

【设计意图】

通过创设参与北京2012年8月天气情况的调查教学情境,让学生亲身经历数据的收集、整理和处理的过程。在合作互助的学习氛围中,提高学生学习的兴趣、探究的积极性。

(二)探究新知

提问:通过数数的方式我们已经知道每种天气各有多少天,那如何清楚地将它们表示出来呢?

组织学生分小组讨论,并组内完成。

小组1:可以用统计表来表示,将统计得到的数据填入表中方便查找。

提问:从这张表中你能得到哪些信息?用统计表表示数据有哪些好处?

小组2:还可以用图形来表示统计结果。

提问:用图形来表示统计结果有哪些优点?是否存在不足?

【设计意图】

通过创设人人都参与的课堂氛围.充分挖掘学生的潜能,尊重学生个体的选择,鼓励学生用自己喜欢的方式描述统计结果.进行有个性的探究活动。

课件出示条形统计图。

观察统计图有什么特点?(介绍横轴、纵轴、单位长度)

(教师边讲解边演示:将不同的天气数量在图中涂上颜色表示出来。)

提问:比较分析哪种图表将数据表示的更清楚?统计图和统计表各有什么特点?

(组织小组内合作交流)

教师总结:这三种方法都能表示出2012卑8月北京市的天气情况,但用统计图的方法来记录统计数据可以更直观地表示数量的多少。

像这样用条形的长短来表示数量多少的统计图,我们把它叫作条形统计图。奈形统计图一般由标题、日期(可以省略)、单位名称、条形、横轴、纵轴等组成。

【设计意图】

学生通过亲手操作获得处理信息的方法,体会统计图和统计表的不同特点,有利于培养学生的问题意识和能力的提高。

(三)深化概念

提问:条形统计图的横轴和纵轴分别表示什么?(横轴表示要统计的内容,纵轴一般表示数量)

【设计意图】

通过探冤用条形统计图来表示2012年8月北京市天气情况的整理、描述、分析过程,明晰各组成部分的作用,以提问的方式进行强化的同时,总结归纳。

(四)应用新知

统计本班同学的出生月份,并用条形统计图表示出来。师生共同完成,小组合作展示。

【设计意图】

将新授知识与学生生活实际相结合再一次激发了学生的学习兴趣,学生在积极参与中,经历了收集、整理数据的过程。通过对自己收集、整理和分析数据的过程,学生体会到统计的必要性,再次体现了“教学来源于生活,应用于生活”的新理念。

(五)小结作业

教师:通过今天的学习大家都收获了什么?想想是怎么得到的,你又从中学到了什幺?

作业:对自己感兴趣的内容进行统计,进行数据分析,设计一个条形统计图。

【设计意图】

小结部分通过学生总结,不仅可以提高学生的总结概括能力,也可以让教师获得学生及时的学习反馈。让学生对自己感兴趣的内容进行数据分析制作条形统计图,使学生明白统计知识是为现实生活服务的。

When the right person is holding the right job at the right moment,that person’s influence is greatly expanded.That is the position in which Janet Yellen,who is expected to be confirmed as the next chair of the Federal Reserve Bank(FeD.in

January,now finds herself.If you believe,as many do,that unemployment is the major economic and social concern of our

day,then it is no stretch to think Yellen is the most powerful person in the world right now.Throughout the 2008 financial

crisis and the recession and recovery that followed,central banks have taken on the role of stimulators of last resort,holding

up the global economy with vast amounts of money in the form of asset buying.Yellen,previously a Fed vice chair,was one of the principal architects of the Fed's$3.8 trillion money dump.A star economist known for her groundbreaking work on labor

markets,Yellen was a kind of prophetess early on in the crisis for her warnings about the subprime(次级债)meltdown.Now it will be her job to get the Fed and the markets out of the biggest and most unconventional monetary program in history without derailing the fragile recovery.The good news is that Yellen,67,is particularly well suited to meet these challenges.She has a keen understanding of financial markets,an appreciation for their imperfections and a strong belief that human suffering was more related to unemployment than anything else.

Some experts worry that Yellen will be inclined to chase unemployment to the neglect of inflation.

But with wages still relatively flat and the economy increasingly divided between the well-off and the long-term

unemployed,more people worry about the opposite,deflation(通货紧缩)that would aggravate the economy’s problems.

Either way,the incoming Fed chief will have to walk a fine line in slowly ending the stimulus.It must be steady enough to

deflate bubbles and bring markets back down to earth but not so quick that it creates another credit crisis.

Unlike many past Fed leaders,Yellen is not one to buy into the finance industry's argument that it should be left alone to

regulate itself.She knows all along the Fed has been too slack on regulation of finance.Yellen is likely to address the issue

right after she pushes unemployment below 6%,stabilizes markets and makes sure that the recovery is more inclusive anD.robust.As Princeton Professor Alan Blinder says,“She’s smart as a whip,deeply logical,willing to argue but also a good

listener.She can persuade without creating hostility.”All those traits will be useful as the global economy’s new power player

takes on its most annoying problems.

What did Yellen help the Fed do to tackle the 2008 financial crisis 《》()

When the right person is holding the right job at the right moment,that person’s influence is greatly expanded.That is the position in which Janet Yellen,who is expected to be confirmed as the next chair of the Federal Reserve Bank(FeD.in

January,now finds herself.If you believe,as many do,that unemployment is the major economic and social concern of our

day,then it is no stretch to think Yellen is the most powerful person in the world right now.Throughout the 2008 financial

crisis and the recession and recovery that followed,central banks have taken on the role of stimulators of last resort,holding

up the global economy with vast amounts of money in the form of asset buying.Yellen,previously a Fed vice chair,was one of the principal architects of the Fed's$3.8 trillion money dump.A star economist known for her groundbreaking work on labor

markets,Yellen was a kind of prophetess early on in the crisis for her warnings about the subprime(次级债)meltdown.Now it will be her job to get the Fed and the markets out of the biggest and most unconventional monetary program in history without derailing the fragile recovery.The good news is that Yellen,67,is particularly well suited to meet these challenges.She has a keen understanding of financial markets,an appreciation for their imperfections and a strong belief that human suffering was more related to unemployment than anything else.

Some experts worry that Yellen will be inclined to chase unemployment to the neglect of inflation.

But with wages still relatively flat and the economy increasingly divided between the well-off and the long-term

unemployed,more people worry about the opposite,deflation(通货紧缩)that would aggravate the economy’s problems.

Either way,the incoming Fed chief will have to walk a fine line in slowly ending the stimulus.It must be steady enough to

deflate bubbles and bring markets back down to earth but not so quick that it creates another credit crisis.

Unlike many past Fed leaders,Yellen is not one to buy into the finance industry's argument that it should be left alone to

regulate itself.She knows all along the Fed has been too slack on regulation of finance.Yellen is likely to address the issue

right after she pushes unemployment below 6%,stabilizes markets and makes sure that the recovery is more inclusive anD.robust.As Princeton Professor Alan Blinder says,“She’s smart as a whip,deeply logical,willing to argue but also a good

listener.She can persuade without creating hostility.”All those traits will be useful as the global economy’s new power player

takes on its most annoying problems.

What do many people think is the biggest problem facing Janet Yellen 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What is the author’s purpose in writing the passage 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What has caused claims of huge structural problems to multiply 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author say helped bring unemployment during the Great Depression 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author think of the expert’s claim concerning unemployment 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author think is the root cause of mass unemployment in America 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What does the author imply in the last paragraph 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What is the most probable reason for some rich people to use a device to record their patterns 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What is the major cause for Europeans’loss of sleep 《》()