当前位置:首页 → 职业资格 → 教师资格 → 小学教育教学知识与能力->认真阅读下列材料,并按要求作答。请根据上述材料完成下列任务:

认真阅读下列材料,并按要求作答。

请根据上述材料完成下列任务:

(1)简单介绍歌曲的音乐特点。(10分)

(2)如指导中年级小学生演唱该歌曲,请拟定教学目标。(10分)

(3)依据拟定的教学目标,结合该歌曲的学习,设计导入环节并说明设计意图。(20分)

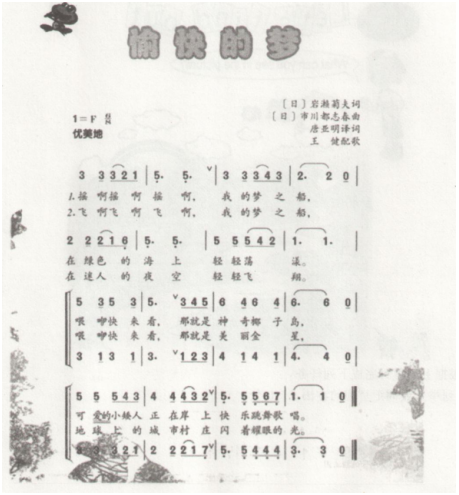

(1)《愉快的梦》是一首优美的抒情儿童歌曲,主要讲述了孩子们梦境中神奇的色彩和孩子对美好事物的向往。歌曲具有摇篮曲的特点,6/8拍,速度较慢,节奏平稳,表现了恬静悠闲的意境。第一乐段旋律音区相对较低,营造了深沉神秘的意境。第二乐段旋律音区较高,色彩明亮,营造出孩子们看到梦中神奇的景观而兴高采烈欢呼的场景.表现了孩子们对美好事物的向往和憧憬。 (2)教学目标

情感态度与价值观目标:感受摇篮曲优美、恬静的音乐风格,树立积极向上的生活态度。

过程与方法目标目标:1~8小节用自然柔和的声音歌唱,9~16小节通过二声部合唱,体会音乐的变化。知识与技能目标:能看懂指挥的手势,整齐的开始和结束,有感情地演唱歌曲。

(3)导入环节

①情景导入,激发兴趣

教师课前将教室布置成比较梦幻的场景。

提出问题:这个场景美不美?有没有哪位同学和大家一起分享,这么美的画面让你联想到什么?

(学生自由发言)

②教师进行总结:大家都觉得这样的场景十分的梦幻、美丽,想象自己在银河、宇宙中自由的翱翔,也有同学想到这样的场景和妈妈在跟自己讲故事时的场景一样的安静、祥和。

今天我们就来学习一首歌曲《愉快的梦》,体会歌曲是怎样表现这样梦幻、美丽的场景的。顺势导入今天的新课《愉快的梦》。

【设计意图】

导入环节运用了创设情境导入方法。通过创设情境,可以激发学生的学习兴趣,提高课堂学习效果。教师将教室装扮成符合本课情境的样子,画面可以吸引学生的注意力,并更好地将学生带入到音乐表达的情境中,使学生更快地将注意力转回到课堂当中,从课下到课上形成了一个自然、生动的过渡,调动学生学习音乐的积极性。也紧贴新课程标准理念中“突出音乐特点,关注学科综合”这一理念。

When the right person is holding the right job at the right moment,that person’s influence is greatly expanded.That is the position in which Janet Yellen,who is expected to be confirmed as the next chair of the Federal Reserve Bank(FeD.in

January,now finds herself.If you believe,as many do,that unemployment is the major economic and social concern of our

day,then it is no stretch to think Yellen is the most powerful person in the world right now.Throughout the 2008 financial

crisis and the recession and recovery that followed,central banks have taken on the role of stimulators of last resort,holding

up the global economy with vast amounts of money in the form of asset buying.Yellen,previously a Fed vice chair,was one of the principal architects of the Fed's$3.8 trillion money dump.A star economist known for her groundbreaking work on labor

markets,Yellen was a kind of prophetess early on in the crisis for her warnings about the subprime(次级债)meltdown.Now it will be her job to get the Fed and the markets out of the biggest and most unconventional monetary program in history without derailing the fragile recovery.The good news is that Yellen,67,is particularly well suited to meet these challenges.She has a keen understanding of financial markets,an appreciation for their imperfections and a strong belief that human suffering was more related to unemployment than anything else.

Some experts worry that Yellen will be inclined to chase unemployment to the neglect of inflation.

But with wages still relatively flat and the economy increasingly divided between the well-off and the long-term

unemployed,more people worry about the opposite,deflation(通货紧缩)that would aggravate the economy’s problems.

Either way,the incoming Fed chief will have to walk a fine line in slowly ending the stimulus.It must be steady enough to

deflate bubbles and bring markets back down to earth but not so quick that it creates another credit crisis.

Unlike many past Fed leaders,Yellen is not one to buy into the finance industry's argument that it should be left alone to

regulate itself.She knows all along the Fed has been too slack on regulation of finance.Yellen is likely to address the issue

right after she pushes unemployment below 6%,stabilizes markets and makes sure that the recovery is more inclusive anD.robust.As Princeton Professor Alan Blinder says,“She’s smart as a whip,deeply logical,willing to argue but also a good

listener.She can persuade without creating hostility.”All those traits will be useful as the global economy’s new power player

takes on its most annoying problems.

What did Yellen help the Fed do to tackle the 2008 financial crisis 《》()

When the right person is holding the right job at the right moment,that person’s influence is greatly expanded.That is the position in which Janet Yellen,who is expected to be confirmed as the next chair of the Federal Reserve Bank(FeD.in

January,now finds herself.If you believe,as many do,that unemployment is the major economic and social concern of our

day,then it is no stretch to think Yellen is the most powerful person in the world right now.Throughout the 2008 financial

crisis and the recession and recovery that followed,central banks have taken on the role of stimulators of last resort,holding

up the global economy with vast amounts of money in the form of asset buying.Yellen,previously a Fed vice chair,was one of the principal architects of the Fed's$3.8 trillion money dump.A star economist known for her groundbreaking work on labor

markets,Yellen was a kind of prophetess early on in the crisis for her warnings about the subprime(次级债)meltdown.Now it will be her job to get the Fed and the markets out of the biggest and most unconventional monetary program in history without derailing the fragile recovery.The good news is that Yellen,67,is particularly well suited to meet these challenges.She has a keen understanding of financial markets,an appreciation for their imperfections and a strong belief that human suffering was more related to unemployment than anything else.

Some experts worry that Yellen will be inclined to chase unemployment to the neglect of inflation.

But with wages still relatively flat and the economy increasingly divided between the well-off and the long-term

unemployed,more people worry about the opposite,deflation(通货紧缩)that would aggravate the economy’s problems.

Either way,the incoming Fed chief will have to walk a fine line in slowly ending the stimulus.It must be steady enough to

deflate bubbles and bring markets back down to earth but not so quick that it creates another credit crisis.

Unlike many past Fed leaders,Yellen is not one to buy into the finance industry's argument that it should be left alone to

regulate itself.She knows all along the Fed has been too slack on regulation of finance.Yellen is likely to address the issue

right after she pushes unemployment below 6%,stabilizes markets and makes sure that the recovery is more inclusive anD.robust.As Princeton Professor Alan Blinder says,“She’s smart as a whip,deeply logical,willing to argue but also a good

listener.She can persuade without creating hostility.”All those traits will be useful as the global economy’s new power player

takes on its most annoying problems.

What do many people think is the biggest problem facing Janet Yellen 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What is the author’s purpose in writing the passage 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What has caused claims of huge structural problems to multiply 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author say helped bring unemployment during the Great Depression 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author think of the expert’s claim concerning unemployment 《》()

What can be done about mass unemployment All the wise heads agree:there’re no quick or any answers.There’s work to be done,but workers aren’t ready to do it.They’re in the wrong places,or they have the wrong skills.Our problem are

“structural,”and will take many years to solve.

But don’t bother asking for evidence that justifies this bleak view.There isn’t any.On the contrary,all the facts suggest

that high unemployment in America is the result of inadequate demand.Saying that there’re no easy answers sounds wise,

but it’s actually foolish:our unemployment crisis could be cured very quickly if we had the intellectual clarity and political will

to act.In other words,structural unemployment is a fake problem,which mainly serves as an excuse for not pursuing real

solutions.The fact is job openings have plunged in every major sector,while the number of workers forced into part-time

employment in almost all industries has soared.Unemployment has surged in every major occupational category.Only three

states,with a combined population not much larger than that of Brooklyn,have unemployment rates below 5%.So the

evidence contradicts the claim that we’re mainly suffering from structural unemployment.Why,then,has this claim become so popular

Part of the answer is that this is what always happens during periods of high unemployment-in part because experts and analysts believe that declaring the problem the problem deeply rooted,with no easy answers,makes them sound serious.I’ve been looking at what self-proclaimed experts were saying about unemployment during the Great Depression;it was almost

identical to what Very Serious People are saying now.Unemployment cannot be brought down rapidly,declared one 1935

analysis,because the workforce is“unadaptable and untrained”.I cannot respond to the opportunities which industry may

offer.A few years later,a large defense buildup finally provided a fiscal stimulus adequate to the economy’s needs anD.suddenly industry was eager to employ those“unadaptable and untrained”workers.But now,as then,powerful forces are

ideologically opposed to the whole idea of government action on a sufficient scale to jump-start the economy.And that,

fundamentally,is why claims that we face huge structural problems have been multiplying:they offer a reason to do nothing

about the mass unemployment that is crippling our economy and our society.

So what you need to know is that there's no evidence whatsoever to back these claims.We aren't suffering from a

shortage of needed skills;we’re suffering from a lack of policy resolve.As I said,structural unemployment isn’t real problem,

it's an excuse-a reason not to act on America’s problems at a time when action is desperately needed.

What does the author think is the root cause of mass unemployment in America 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What does the author imply in the last paragraph 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What is the most probable reason for some rich people to use a device to record their patterns 《》()

It would be all too easy to say that Facebook’s market meltdown is coming to an end.After all,Mark Zuckerberg’s social

network burned as much as$50 billion of shareholders’wealth in just a couple months.To put that in context,since its debut(初次登台)on NASDAQ in May,Facebook has lost value nearly equal to Yahoo,AOL,Zynga,Yelp,Pandora,Open Table,

Group on,LinkedIn,and Angie's List combined,plus that of the bulk of the publicly traded newspaper industry:

As shocking as this utter failure may be to the nearly 1 billion faithful Facebook users around the world,it’s no surprise to

anyone who read the initial public offering(IPO)prospectus(首次公开募股说明书).Worse still,all the crises that emerged

when the company debuted-overpriced shares,poor corporate governance,huge challenges to the core business,and a

damaged brand-remain today.Facebook looks like a prime example of what Wall Street calls a falling knife-that is,one that

can cost investors their fingers if they try to catch it.

Start with the valuation.To justify a stock price close to the lower end of the projected range in the IPO,say$28 a share,Facebook’s future growth would have needed to match that of Google seven years earlier.That would have required

increasing revenue by some 80 percent annually and maintaining high profit margins all the while.

That’s not happening.In the first half of 2012,Facebook reported revenue of$2.24 billion,up 38 percent from the same

period in 2011.At the same time,the company’s costs surged to$2.6 billion in the six-month period.

This so-so performance reflects the Achilles’heel of Facebook’s business model,which the company clearly stated in a

list of risk factors associated with its IPO:it hasn’t yet figured out how to advertise effectively on mobile devices,The number

of Facebook users accessing the site on their phones surged by 67 percent to 543 million in the last quarter,or more than

half its customer base.

Numbers are only part of the problem.The mounting pile of failure creates a negative feedback loop that threatens Facebook’s future in other ways.Indeed,the more Facebook’s disappointment in the market is catalogued,the worse Facebook’s

image becomes.Not only does that threaten to rub off on users,it’s bad for recruitment and retention of talented hackers,who are the lifeblood of Zuckerberg’s creation.

Yet the brilliant CEO can ignore the sadness and complaints of his shareholders thanks to the super-voting stock he

holds.This arrangement also was fully disclosed at the time of the offering.It’s a pity so few investors apparently bothered to

do their homework.

What is the major cause for Europeans’loss of sleep 《》()