资料:Being financially secure in retirement just doesn't happen magically. It takes lots of planning, time and savings.

Some scary facts about retirement:

More than 50% of persons do not have enough finances for retirement.

25% do not participate in their company's retirement plan.

The average person spends 20 years in retirement.

Here are some tips to help you plan correctly:

1. Talk to a financial professional. Every few years, it's a good idea to schedule a meeting with a financial planner to get a “check-up”. It's just like a doctor's visit, and you should really talk about your present situation and future goals.

2. Save, save, and keep on saving. Make it a habit to save as much as you can.

3. Learn your retirement needs. Retirement can be expensive. Learn from today how much you need to save for your retirement. Talk to a financial planner, or find an online retirement calculator.

4. Take part in your employer's retirement plans. If your company offers one, it is usually the best tool you can use. Talk to a financial professional for all your options.

5. Learn about pension plans. If you have an employer or government pension plan, learn all the details.

6. Keep your retirement savings off-limits. Don't make a withdrawal until you retire. You might incur penalties and it will be a setback for realizing your goals.

7. Get your employer to start one, and it can help you tremendously.

8. Learn about your government's retirement plans. Every country has different plans, some with special tax incentives, so learn what your country offers and plan accordingly.

9. Do your own research. Use the Internet, read the newspapers and magazines, talk to your friends, to find out as much as you can about retirement.

What will happen if you withdraw your retirement savings before you retire?

本题考查的是细节理解。

【关键词】What will happen; withdraw your retirement savings; before you retire

【主题句】Keep your retirement savings off-limits. Don’t make a withdrawal until you retire. You might incur penalties and it will be a setback for realizing your goals.坚持存储退休金。 不要在退休前提款,否则你可能会受到惩罚,并且会阻碍你实现目标。

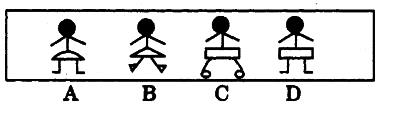

【解析】题干意为“当你在退休前中途取出退休金会怎样?”选项A意为“你将支付罚款”;选项B意为“你将无法实现自己的目标”;选项C意为“你的退休金将会超出范围”;选项D意为“你应该为你的退休金再一次存钱”。根据主题句,结合题意故选B。

下列关于公司的表述,正确的是()

以下各项列举了我国常见气象灾害与其发生地区的对应关系,其中正确的一项是()

根据电视收视率调査,看体育节目的观众中青年人比中老年人要多。

由此可推断出()

—种海洋蜗牛产生的毒素含有多种蛋白,把其中的一种给老鼠注射后,会使有两星期大或更小的老鼠陷入睡眠状态,而使大一点的老鼠躲藏起来。当老鼠受到突然的严重威胁时,非常小的那些老鼠的反应是呆住,而较大的那些老鼠会逃跑。

以上陈述的事实最有力地支持了以下哪项假说?()

疾病控制中心对某校髙中三个年级的学生进行抽样做视力状况调查,抽样的方法为分层抽样(按比例抽样),若高中一、二、三年级学生人数分别为626、703、780,样本容量为84,则应从离二年级抽样的学生人数为多少?()