资料:FAST cars whizz around,malls are full of expensive luxuries and cranes dominate the skyline.But scratch the shimmering surface of the Gulf and you soon find countries hurting from the low oil price,currently around $40 a barrel.Growth is slowing and unemployment is rising.Policy makers even dare utter a three-letter“t” word until recently taboo:tax.

Oil is central to the six Gulf Co-operation Council (GCC) states,which have used the windfall of the past few years to spend lavishly.Unlike many oil exporters,such as Nigeria and Venezuela,they have high foreign-exchange reserves and low debts to cover short-term gaps.But public spending is generous and the private sector is heavily reliant on oil to boot.To be sustainable in an era of lower prices.the rulers must change the structure of their economies.

The IMF reckons the lower oil price knocked $340 billion off Arab oil-exporting states’ government revenues in 2015.This year is looking worse.Moody’s,a ratings agency,this month downgraded Bahrain and Oman and put on watch the other four GCC states: Saudi Arabia,Kuwait,the United Arab Emirates (UAE) and Qatar.“It’s the end of an era for the Gulf,”says Razan Nasser of HSBC in Dubai.“And we’re only just starting to see the effects.”

Oil receipts typically account for more than 80% of GCC government revenues,rising to over90% of Saudi Arabia’s budget before the crisis.Dubai,one of the emirates making up the UAE,is an exception,with oil accounting for only 5% of revenues.That is because it has successfully diversified tourism and services account for most of its government revenues.

Governments are reacting to the squeeze on their incomes with a mixture of strategies,drawing down reserves and taking on debt on the one hand,and imposing spending cuts on the other.Last year they made tweaks,such as curbing benefits for public servants.This year will be tougher.Oman has told all state-owned enterprises to remove perks such as cars.Qatari companies including Al Jazeera and the Qatar Foundation,a cultural organization,have laid off employees.With such tweaks, Kuwait,the UAE and Qatar,which have small populations and high foreign exchange reserves,can get by for a decade.

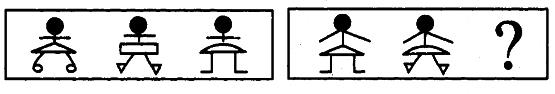

Which of the following choice all contains GCC states?

本题考查的是细节理解。

【关键词】following statement;true

【主题句】第3自然段Moody’s,a ratings agency,this month downgraded Bahrain and Oman and put on watch the other four GCC states: Saudi Arabia,Kuwait,the United Arab Emirates (UAE) and Qatar.评级机构穆迪本月降低了巴林和阿曼的评级,并关注其他四个海湾合作委员会国家——沙特阿拉伯、科威特、阿拉伯联合酋长国(阿联酋)和卡塔尔。

【解析】本题的问题是“以下哪种选择包含的都是海湾合作委员会国家?”A选项“沙特阿拉伯、阿联酋、委内瑞拉”;B选项“卡塔尔、科威特、尼日利亚”;C选项“巴林、阿曼、卡塔尔”;D选项“伊朗、科威特、迪拜”。根据主题句,海湾合作委员会国家包括了巴林、阿曼、沙特阿拉伯、科威特、阿拉伯联合酋长国(阿联酋)和卡塔尔,因此C选项正确。

下列关于公司的表述,正确的是()

以下各项列举了我国常见气象灾害与其发生地区的对应关系,其中正确的一项是()

根据电视收视率调査,看体育节目的观众中青年人比中老年人要多。

由此可推断出()

—种海洋蜗牛产生的毒素含有多种蛋白,把其中的一种给老鼠注射后,会使有两星期大或更小的老鼠陷入睡眠状态,而使大一点的老鼠躲藏起来。当老鼠受到突然的严重威胁时,非常小的那些老鼠的反应是呆住,而较大的那些老鼠会逃跑。

以上陈述的事实最有力地支持了以下哪项假说?()

疾病控制中心对某校髙中三个年级的学生进行抽样做视力状况调查,抽样的方法为分层抽样(按比例抽样),若高中一、二、三年级学生人数分别为626、703、780,样本容量为84,则应从离二年级抽样的学生人数为多少?()