资料:In the United States of America, banks are categorized into the federally-chartered bank which received their charter from the Office of the Comptroller of the Currency(OCC); these are referred to as “National Banks”; and also the states-chartered banks which receive their charter from the superintendent to as “State Banks”. Banks are allowed to register either with the federal or the state authority. Let us now look at the organizational structure of Commercial Banks, which include unit banking, group banking and branch banking.

The main characteristic of unit banking is that it can operate only a single full service bank from a single location. Unit banking institutions are not allowed to have branch networks. However, unit banking does not necessarily have to be small. In fact, many unit banks are quite large.

Group banking refers to banking operations conducted by a corporation owning more than one bank. The group banking system usually exists in the states where branch banking is prohibited.

As for branching, it is sometimes referred to “limited branching” or “stateside branching”. Limited branching allows bank to operate branches within geographic territories authorized by the state law. Stateside branching implies that bank branches are allowed to operate anywhere within the state. New York State, California, Florida and some others are stateside branch banking areas which Minnesota, Arkansas, lower and others are limited branching areas.

In the United States, there are also specialized banks including the Edge Act Banks, the international Banking Facility, the bankers’ banks, the saving banks, the savings and loans associations, the credit unions and government owned and the Real Estate Investment Trust (TEIT).

There are also non-bank financial institutions in the USA, including the securities firms, the leasing and commercial finance companies, the mortgage bankers and the Real Estate Investment Trust (REIT).

Let us now look at the Federal System. Commonly known as the Federal Reserve Bank or the “Fed”, this is the Central Bank of the United States founded in 1913. It determines the reserve requirement within limits set by the US Congress. The function of the Fed is economic stabilization through the management of the nation’s money supply. The Federal Reserve System comprises a board of governors with 7 members stationed in Washington D.C Reserve Banks, including Boston,New York City, Dallas and San Francisco.

The Federal Reserve Act(FRA)1913 set out the powers of the Fed which, on top of the regular central bank’s objectives, emphasize the following.

i.Managing the monetary system and money supply of the USA;

ii.Providing funds as the lender of last report;

iii.Providing for an efficient cherub clearing system;

iiii.Providing a rigorous banking supervision system.

Which of the following is not true?( )

本题考查细节理解。

【关键词】which of the following; not true

【主题句】

第一段In the United States of America, banks are categorized into the federally-chartered bank which received their charter from the Office of the Comptroller of the Currency (OCC); these are referred to as “National Banks”; and also the states-chartered banks which receive their charter from the superintendent to as “State Banks”. 在美利坚合众国,银行被分类为联邦特许银行(即由通货审计官办公室(OCC)发放牌照,被称为“国家银行”)以及国家特许银行(即由监管机构发放牌照,被称为“国有银行”)。

第三段第二句The group banking system usually exists in the states where branch banking is prohibited. 集团银行系统通常存在于禁止分支银行的州。

第四段第二句Limited branching allows bank to operate branches within geographic territories authorized by the state law. Stateside branching implies that bank branches are allowed to operate anywhere within the state. 有限的分支机构允许银行在州法律授权的地域内经营分支机构。美国分支机构意味着银行分支机构可以在该州任何地方运营。

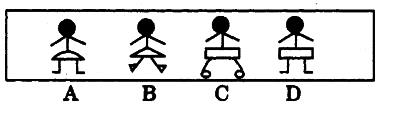

【解析】题目意为“以下哪个选项不正确?”选项A意为“美国国家银行即是 ‘国有银行’”;选项B意为“集团银行系统通常存在于禁止分支银行的州”;选项C意为“分支机构意味着银行分支机构可以在该州任何地方运营”;选项D意为“有限分支允许银行在州法律授权的地域内经营分支机构”。根据主题句,只有选项A与题意不相符。

下列关于公司的表述,正确的是()

以下各项列举了我国常见气象灾害与其发生地区的对应关系,其中正确的一项是()

根据电视收视率调査,看体育节目的观众中青年人比中老年人要多。

由此可推断出()

—种海洋蜗牛产生的毒素含有多种蛋白,把其中的一种给老鼠注射后,会使有两星期大或更小的老鼠陷入睡眠状态,而使大一点的老鼠躲藏起来。当老鼠受到突然的严重威胁时,非常小的那些老鼠的反应是呆住,而较大的那些老鼠会逃跑。

以上陈述的事实最有力地支持了以下哪项假说?()

疾病控制中心对某校髙中三个年级的学生进行抽样做视力状况调查,抽样的方法为分层抽样(按比例抽样),若高中一、二、三年级学生人数分别为626、703、780,样本容量为84,则应从离二年级抽样的学生人数为多少?()