资料:Italy's next government, a coalition between the populistFive Star Movement and the far-right Northern League, is giving investors plenty to worry about. Leaked plans, hastily abandoned, suggested it might want to leave the euro or ask the European Central Bank to forgive €250bn($292bn) of Italian debt. But less attention has been paid to what it might mean for Italian banks, and in particular for their biggest burden: non-performing loans(NPLs). Over €185bn of NPLs were outstanding at the end of 2017, the most for any country in the European Union. (1)

By comparison with Greece where NPLs are 45% of loans, Italy looks manageable with just 11.1%. And it has made progress: in late 2015 NPLs were 16.8% of loans. But any wild policy lurches would put that progress in question. The clean-up of banks’ books has relied on openness to foreign investors. Huge volumes of NPLs(€37bn in 2016 and over €47bn in 2017, according to Deloitte, a consultancy) have been sold by banks, often to specialist American hedge funds like Cerberus Capital Management or Fortress. (2)

These so-called vulture funds may find life harder under the new government. Given the importance of being able to repossess the collateral for secured loans, NPL investors have been taken aback by a proposal to prevent any action against a debtor without the involvement of a court. This would run counter to efforts to increase the use of out-of-court settlement for collateral across the EU. (3)

The future of GACS, a scheme for providing an Italian government guarantee to the senior tranches of NPL securitisations (with the EU's blessing), is also in question. Despite a slow start in 2016, it has come to play a large role. An NPL sale last year by UniCredit, a large bank, worth€l7.7bn, was subject to the scheme. Another €38bn-worh of Italian NPL deals in progress will be too, according to Debtwire, a news service. But investors now worry that GACS will not be renewed once it expires失效 in September, contrary to previous plans. (4)

European regulators have made a concerted effort to deal with NPLs. In March the European Commission proposed laws to make cross-border operations easier for debt (5)

Markets have deepened in tandem. As well as the specialist funds doing large deals,more options for trading NPLs have emerged. One example is Debitos, a trading platform that started in Germany and that allows investors to trade in NPLs from 11 European countries, including Italy and Greece. Most of its sales are between €50m and €200m and interest often comes from local investors, says Timur Peters, its founder—for example, from individuals who buy property—backed NPLs as a way to acquire those properties. (6)

A liquid pan-European market in NPLs ought to prevent banks’ bad loans from accumulating and threatening their stability, as during the most recent crisis. But Italy would, because of its sheer size, be the largest source of such loans for the foreseeable future. And any market with real doubts about the largest supplier is almost certain to be a stunted one. (7)

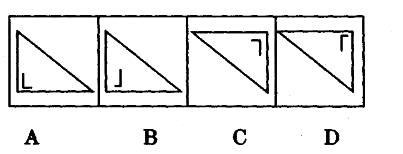

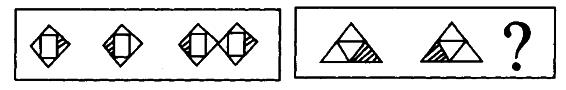

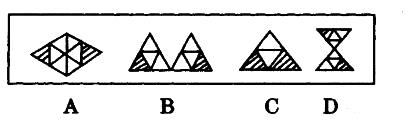

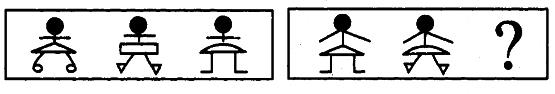

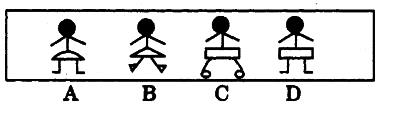

Which is incorrect about the chart?

本题考查的是细节判断。

【关键词】incorrect,chart

【主题句】见表格

【解析】题目意为“根据表格,以下哪项是错误的?”选项A意为“2017年意大利总贷款约为16670亿欧元”,由表格可知,意大利2017年4月贷款约为18850亿欧元,占整年总贷款的,因此意大利整年总贷款为亿欧元,故选项A正确。选项B意为“希腊NPL总贷款占比是最高的”,根据表格可以看到,希腊总贷款占比为,为所有表格中国家最高,故选项B正确。选项C意为“尽管不良贷款率较低,但希腊的贷款总额远远高于西班牙”,根据表格可以看出,希腊的总贷款亿欧元,西班牙总贷款亿欧元,故选项C错误。选项D意为“2017年法国总贷款是表格中最高的,约为43500亿欧元”,根据表格,运算可知,选项D正确。题目要求选择错误的一项。

下列关于公司的表述,正确的是()

以下各项列举了我国常见气象灾害与其发生地区的对应关系,其中正确的一项是()

根据电视收视率调査,看体育节目的观众中青年人比中老年人要多。

由此可推断出()

—种海洋蜗牛产生的毒素含有多种蛋白,把其中的一种给老鼠注射后,会使有两星期大或更小的老鼠陷入睡眠状态,而使大一点的老鼠躲藏起来。当老鼠受到突然的严重威胁时,非常小的那些老鼠的反应是呆住,而较大的那些老鼠会逃跑。

以上陈述的事实最有力地支持了以下哪项假说?()

疾病控制中心对某校髙中三个年级的学生进行抽样做视力状况调查,抽样的方法为分层抽样(按比例抽样),若高中一、二、三年级学生人数分别为626、703、780,样本容量为84,则应从离二年级抽样的学生人数为多少?()